how to avoid paying nanny tax

The IRS estimates that it can take a. By paying nanny taxes an employer running a business can avoid legal notice.

How Much Can You Pay A Nanny Without Paying Taxes In 2022

If your employee files for unemployment benefits after her employment with you ends and you havent paid your state.

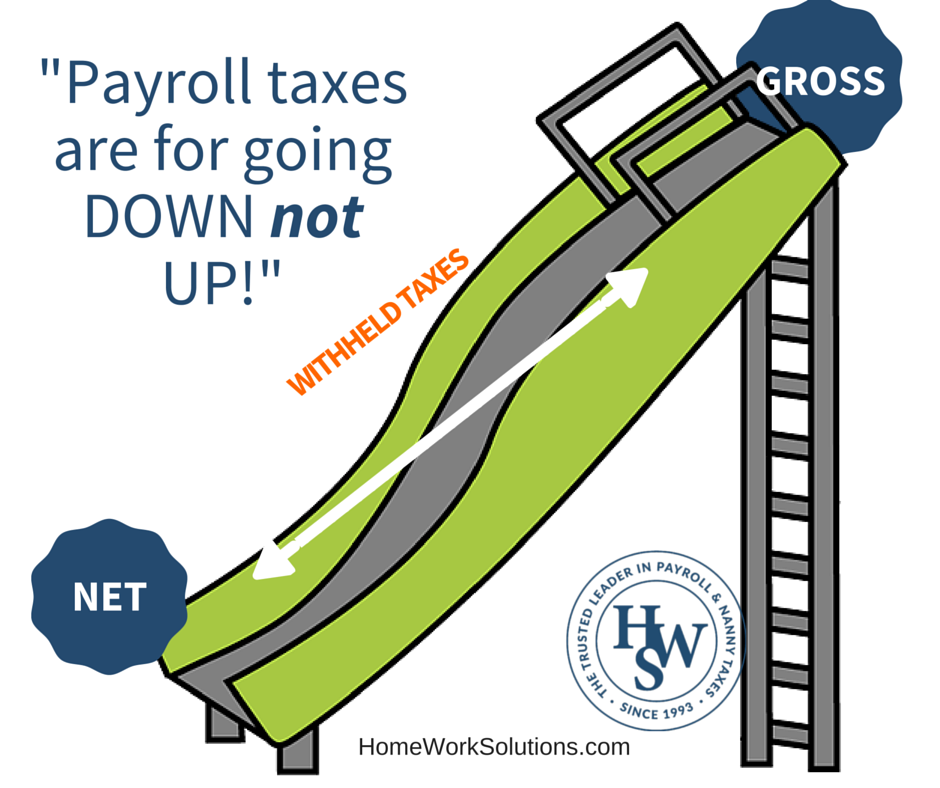

. To break this down further you and your employee are each responsible for. Social Security taxes will be 62 percent of your nannys gross before taxes. Paying or Avoiding the Nanny Tax By Sue Shellenbarger.

Complete year-end tax forms. The unemployment tax is 62 percent of your employees FUTA. You dont have to be audited in order to be caught by the IRS.

Pay your weekly maid no more than 2883 per house cleaning. You generally must pay unemployment tax on the first 7000 of wages you pay each household employee. Simply divide your nannys total annual salary by 12.

President from Clinton to Trump. Pay your every other week maids no more than 5765 per home cleaning. Parents who hire a babysitter and pay nanny taxes can claim child care credit.

These taxes are collectively known as FICA and must be withheld from your nannys pay. Some of the richest. The 2022 nanny tax threshold is 2400 which means if a.

FICA taxes are 153 of the employees wages. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return. This will equal the nannys gross monthly wages before federal and state taxes are withheld.

Failure to pay the Nanny Tax has resulted in numerous high-profile scandals involving political appointees of every US. The Social Security Administration. This ongoing parade of Nannygate.

If your nannys salary is. Everything You Need to Know about Paying Nanny Taxes. Become a Business Savant.

It builds a good relationship. 5 2008 123 pm ET Reporting this weeks Work Family column on how fewer parents are paying nanny taxes. Find a time machine to.

Tips to avoid the Nanny Tax. Its time-consuming and may seem overwhelming. Its no secret that businesses have the most leverage when it comes to tax credits tax deductions or tax write-offs.

The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount. Nanny taxes are relatively simple to calculate.

Nanny Household Employment Tax Who Owes It Taxact

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax College Survival Guide

Nanny Tax Threshold For 2021 Sees Slight Increase Of 100

Sick Pay Statutory Sick Pay For Nannies Nannytax

:max_bytes(150000):strip_icc()/IsItOKToPayMyNannyinCash-4d00db8cf26f4f7a99abbfa0670e8ce5.jpg)

Is It Ok To Pay My Nanny In Cash

Tax Tips The Nanny Tax Not Just For Nannies Organized Instincts

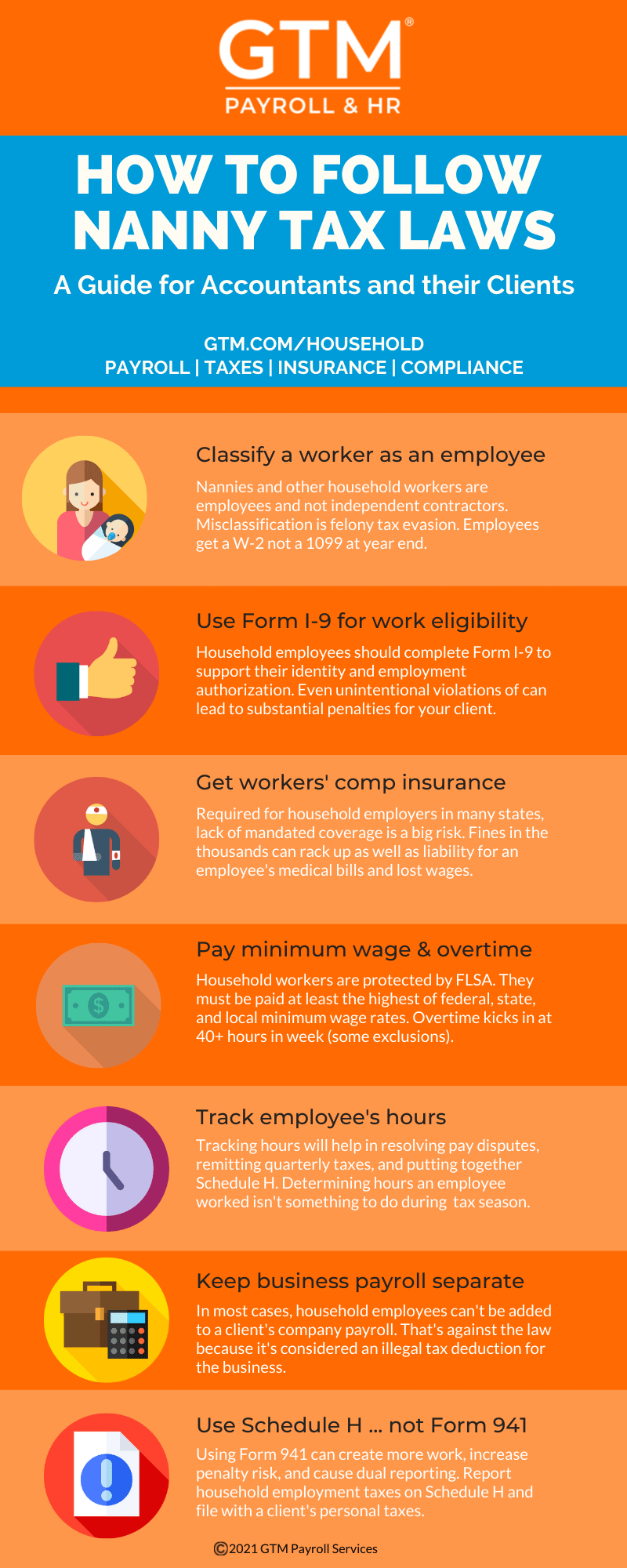

A Guide To Nanny Tax Compliance For Accountants And Their Clients

Paycheck Nanny On The App Store

Tips And Advice On How To Pay Your New Nanny

Nanny Payroll Part 3 Unemployment Taxes

3 Ways To Pay Nanny Taxes Wikihow Life

Help I Was Given A 1099 Nanny Counsel

Tax Payroll Information Beach Baby Nannies

Household Employment Blog Nanny Tax Information Nanny Payroll Tax 3

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Does The Household Employee Tax Apply To Me And What To Do Mark J Kohler

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Should I Pay Taxes On My Nanny Georgia S Dream Nannies Atlanta Nanny Service Palmetto Bluff Nannies Bluffton Nanny Service Hilton Head Nannies South Carolina Nanny Agency